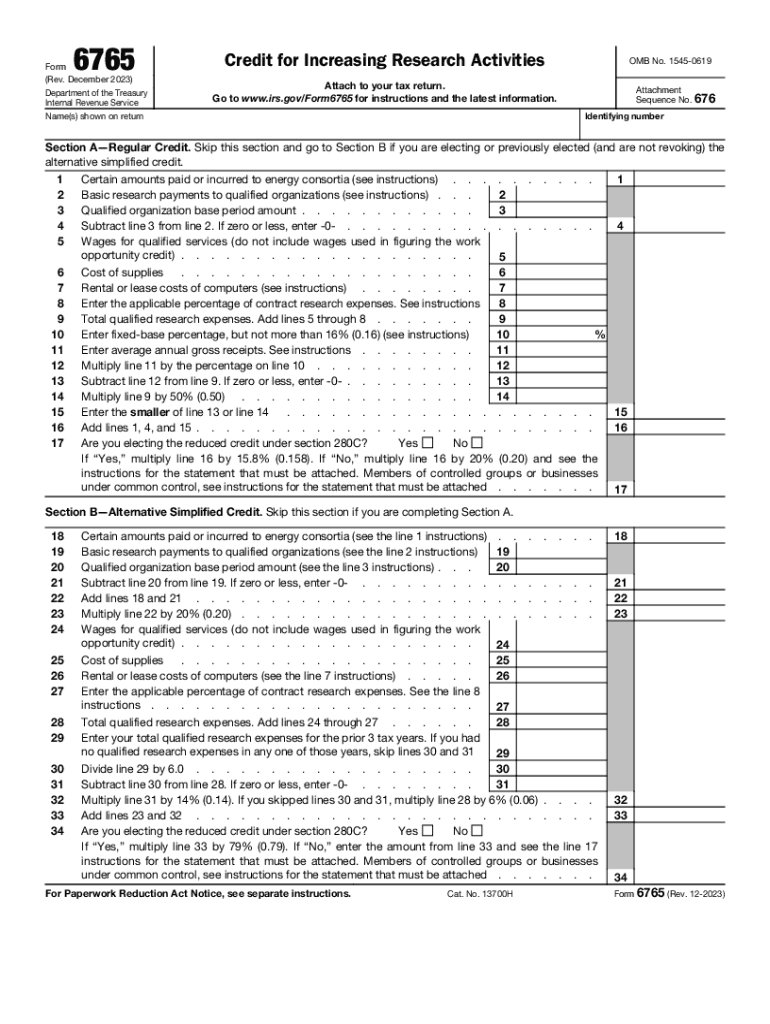

2025 Form 6765 - IRS Form 6765 Instructions Tax Credit For Research Activities, On september 15, 2025, the irs released a preview of the proposed changes to form 6765, credit for increasing. September 21, 2025 · 5 minute read. Form 6765 Credit for Increasing Research Activities (2014) Free Download, Use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain. Recent legislation has doubled the potential value of the sec.

IRS Form 6765 Instructions Tax Credit For Research Activities, On september 15, 2025, the irs released a preview of the proposed changes to form 6765, credit for increasing. September 21, 2025 · 5 minute read.

The irs’s proposed alterations to form 6765 align with changes made in 2022, concerning amended returns for r&d credit refunds.

Form 6765 is the form taxpayers attach to an original or amended federal tax return to report qualifying research expenditures (qres) and their associated claim.

2025 Form 6765. Recent legislation has doubled the potential value of the sec. Taxpayers attach form 6765 to an original or amended income tax return to report qualifying research expenditures (qres) and their claim for a r&e credit.

R&D Tax Credit form 6765 YouTube, 41 research and development (r&d) federal tax credit. Learn how to navigate these changes effectively.

SSC Form Fillup 2025 SSC 2025 Form Fillup SSC Form Fillup Date 2025, Check back frequently because the forms are updated on a regular basis, and the filing rules can. Use form 6765 to figure and claim the credit for increasing research activities, to elect the reduced credit under section 280c, and to elect to claim a certain.

StepbyStep Guide How to Fill Out Form 6765 for R&D Tax Credits Fill, The irs is changing form 6765 for r&d credits in 2025. The irs is seeking feedback from stakeholders on proposed changes to form 6765 , credit for increasing research activities, also known.

Form 6765 ≡ Fill Out Printable PDF Forms Online, As we venture further into 2025, the impending revisions to form 6765 loom over businesses aiming to claim research and development (r&d) tax credits. The previewed changes to form 6765 are intended, when the form is published in final form, to be effective beginning with the tax year 2025.

6765 Instructions 20252025 Form Fill Out and Sign Printable PDF, Explore upcoming changes to irs form 6765 for r&d tax credits. The irs is seeking feedback from stakeholders on proposed changes to form 6765 , credit for increasing research activities, also known.

IRS releases proposed Form 6765 changes for 2025 Crowe LLP, Check back frequently because the forms are updated on a regular basis, and the filing rules can. The addition of qualitative questions to the top of the form;

The new form 6765 for tax year 2025 brings significant changes to how research activities and expenses are reported.

Discover the irs’s proposed overhaul to form 6765 for r&d tax credits, demanding more data and time. The irs’s proposed alterations to form 6765 align with changes made in 2022, concerning amended returns for r&d credit refunds.

March 2025 Calendar Printable, Form 6765 is the form taxpayers attach to an original or amended federal tax return to report qualifying research expenditures (qres) and their associated claim. Discover what's changing and how your organization can prepare for the new reporting requirements.

2025 ADAM Annual Conference, Explore upcoming changes to irs form 6765 for r&d tax credits. Here’s what you need to know about irs.